- Forgot Username or Password?

- Register a New Account

So, you need some extra cash to start a home remodel, or to pay off debt, or for another reason, and now you’re unsure which loan option would be better for you: a Home Equity Loan (Fixed 2nd Mortgage) or a Home Equity Line of Credit (HELOC). Which do you choose?

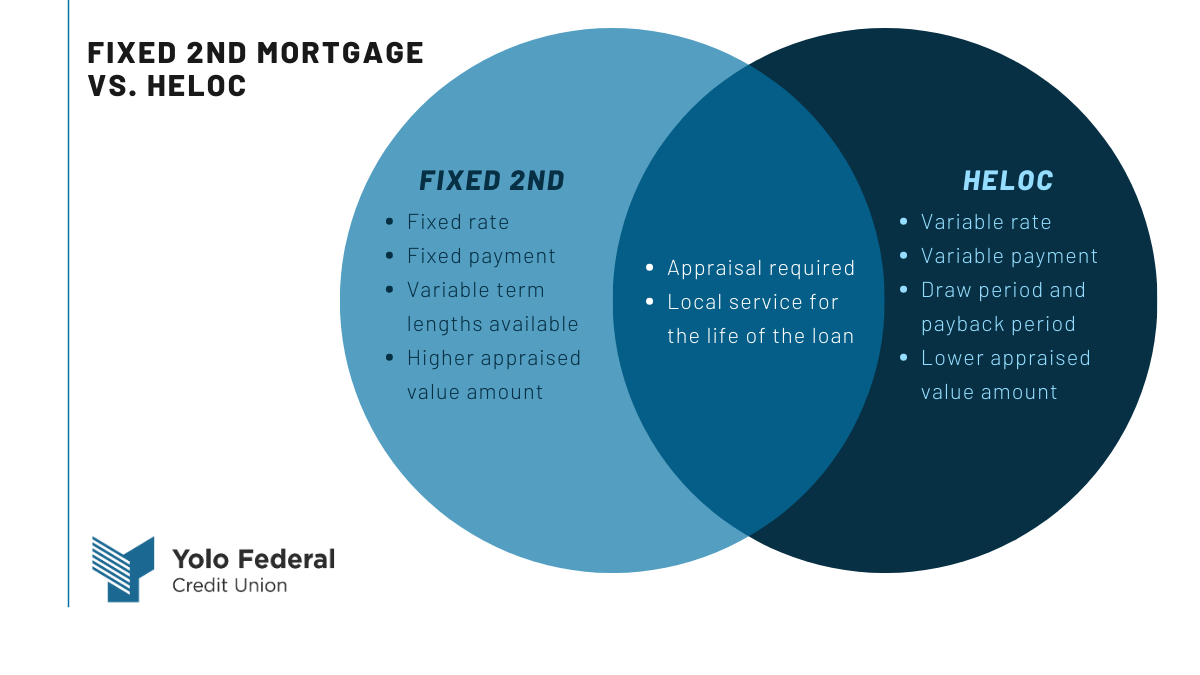

Before you make your decision, it’s essential to know the difference between the two loan types. Check out the diagram below to compare a Fixed 2nd Mortgage versus a HELOC.

No matter your choice, you can count on Yolo Federal Credit Union to see you through. Schedule an appointment with a representative to get started.